But set a goal of increasing sales and inventory turnover to improve cash flow to the extent possible. However, it should be noted that this metric cannot directly be compared across different industries or company sizes. Many variables should be examined in conjunction with accounts payable turnover ratio. Only then can you develop a complete picture of a company’s financial standing. In the 4th quarter of 2023, assume that Premier’s net credit purchases total $3.5 million and that the average accounts payable balance is $500,000. This article explores the accounts payable turnover ratio, provides several examples of its application, and compares the metric with several other financial ratios.

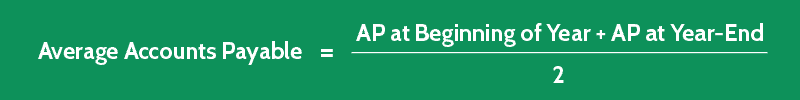

Formula To Calculate Accounts Payable Turnover Ratio :

Mosaic integrates with your ERP to gather all the data needed to monitor your AP turnover in real time. With over 150 out-of-the-box metrics and prebuilt dashboards, Mosaic allows you to get real-time access to the metrics that matter. Look quickly at metrics like your AP aging report, balance sheet, or net burn to get vital information about how the business spends money.

Why You Should Track AP Turnover

That can help investors determine how capable one company is at paying its bills compared to others. Investors can use the accounts payable turnover ratio to determine if a company has enough cash or revenue to meet its short-term obligations. Creditors can use the ratio to measure whether to extend a line of credit to the company.

AP turnover

A ratio below six indicates that a business is not generating enough revenue to pay its suppliers in an appropriate time frame. Bear in mind, that industries operate differently, and therefore they’ll have different overall AP turnover ratios. This ratio provides insights into the rate at which a company pays off its suppliers. Accounts production activities payable are the amounts a company owes to its suppliers or vendors for goods or services received that have not yet been paid for. Accounts receivable turnover ratio is another accounting measure used to assess financial health. Accounts receivable (AR) turnover ratio simply measures the effectiveness in collecting money from customers.

High AP turnover ratios

Effective cash management helps a company balance the goal of paying vendors quickly with the need to maintain a specific cash balance for operations. Analyze both current assets and current liabilities, and create plans to increase the working capital balance. Working capital is calculated as (current assets less current liabilities), and management aims to maintain a positive working capital balance. In other words, businesses always want the current asset balance to be greater than the current liability total.

- Generating a higher ratio improves both short-term liquidity and vendor relationships.

- The accounts payable turnover ratio is a measurement of how efficiently a company pays its short-term debts.

- To know whether this is a high or low ratio, compare it to other companies within the same industry.

- When you take early payment discounts, your inventory costs less, and your cost of goods sold decreases, improving profitability.

- Accounts payable are the amounts a company owes to its suppliers or vendors for goods or services received that have not yet been paid for.

Technology companies often need to purchase components and materials from suppliers to manufacture their products. A high Accounts Payable Turnover Ratio can help them maintain good relationships with their suppliers and ensure a steady supply of materials. This can help them meet production deadlines and improve their overall efficiency.

With the right mindset, you can strategically leverage your AP team, using AP reports and metrics to further business goals and boost your bottom line. If the AP turnover ratio is 7 instead of 5.8 from our example, then DPO drops from 63 to 52 days. A high turnover ratio implies lower accounts payable turnover in days is better.

Although your accounts payable turnover ratio is an important metric, don’t put too much weight on it. Consult with your accountant or bookkeeper to determine how your accounts payable turnover ratio works with other KPIs in your business to form an overall picture of your business’s health. The investor can see that Company B paid off its suppliers at a faster rate than Company A. That could mean that Company B is a better candidate for an investment.