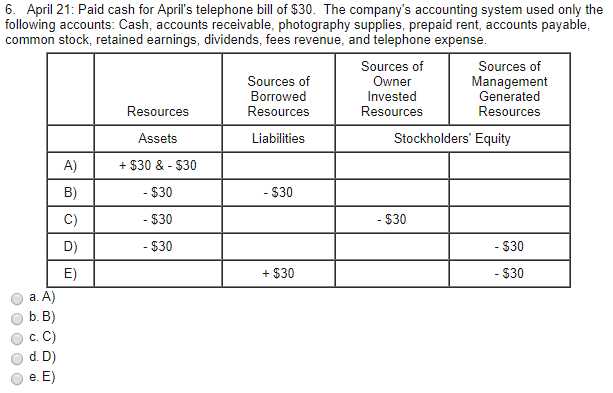

You are reducing the cash asset, so you are going to credit cash. In the example below, assume we issue payments for both of the bills in our previous journal entries. Another common term used instead of accounts payable is creditors. When the company makes the payment, they have to reverse the accounts payable and cash out. Telephone bill is a statement sent by a service provider to a customer that lists the charges for the services used.

Examples for How to Journalize Paying a Bill in Accounting

J) George Burnham pays the amount owing to the telephone company on the 13th of May. Ensure we record amounts accurately and choose appropriate GL accounts to journalize the transactions. Finally we are going to add administrative expenses to Income statement – they increase by 150. Keeping track of all of your business transactions shows you how cash flows in and out of your company. Using the direct method, when you realize an accounts receivable account is uncollectible, you write off the amount to bad debt. While this might seem like a small distinction, accounting and financial statements are all about the details.

Understanding the Accounts Payable Function

For simplicity’s sake, also assume that the firm began operations on Monday 2 January 2017. Finally, the journal entry on 2 January 2020 reflects the second payment of principal and interest. It is common for bills to be received after the end of the year, which actually relate to a service received before the year-end. First, understand the accounting rules, figure out the nature of the accounts and apply the rules.

Why You Can Trust Finance Strategists

- A company records an increase in this liability each period as the amount of accrued interest increases.

- You will do this with the accounts payable account, which represents amounts your business owes to other parties from normal business operations.

- So, we need to debit all the fees per the Nominal account rule and credit it with Cash as per the Real Account Rules.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- When the actual invoice arrives, we have to record the expense and accounts payable.

The journal entry is debiting accounts payable $ 500 and credit cash $ 500. An adjusting entry for accrued salaries expenses is made to recognize the wages earned by employees but not yet paid. For this purpose, a credit to salaries payable and a debit to salaries expenses are necessary.

The interest expense for the next quarter is based on the new balance in the notes payable account of $7,500. Paid Cash for Telephone bill is to record the regular business communication expenses. So, we need to debit all the fees per the Nominal account rule and credit it with Cash as per the Real Account Rules. This debit shows that your expense account has increased—or the transaction has increased your total costs. Therefore, businesses meet their regular telephone expenses through petty Cash as the telephone expenses are negligible. If the employee is paying (reimbursing) the company immediately, you can record the entire phone bill with a debit of $100 to the company’s account Telephone Expense.

Is an Expense a Debit or Credit in a Journal Entry?

This way, your monthly expenses take rent into account, even if you paid for it ahead of time. For instance, say you have a customer with an outstanding bill worth $1,000. If that customer goes out of business and can’t pay the bill, here’s how you’ll record that expense using the direct write-off method. In the above example, the note and the interest are paid quarterly. The interest is based on the previous outstanding principal balance of the note. At the beginning of the new period, the company has to reverse this transaction and wait for the actual invoice from the supplier.

Telephone expense is the cost that company spends on the landline, phone service, or other phone usages during the accounting period. According to the accrual concept of accounting, expenses are recognized when incurred regardless of when paid. Therefore, if no entry was made for it in December then an adjusting entry is necessary. Okay, now that we’ve worked out which accounts are affected and the impact on the basic accounting equation, let’s tackle the debit and credit journal entry. As you can see above, the owner’s stake in the assets of the business (i.e. owner’s equity) decreases by $200 to $25,800. Remember that the term accounts payable refers to the value of debts to our suppliers for goods and services we have received but not yet paid for.

In other words, each accounting record includes a debit and a credit, and the amount of debit and credit should be equal for each record. In the adjusting entry above, Utilities Expense is debited to recognize the expense and Utilities Payable to record a liability since the amount is yet to be paid. Therefore, on 1 October 2019, the interest expense is $200, or 8%, of $10,000 for 3 months.

But since we’re now paying the telephone company, this means that we owe them less. You will debit the utilities expense account and credit accounts payable. Suppose you paid telephone bill journal entry receive an invoice for the purchase of $50,000 of merchandise you will resell. You will record this invoice as a debit to inventory and a credit to accounts payable.

The Entry to record these paid telephone expenses by cheque is nothing but payment through the bank. Telephone charges are in the nature of expenses and fall under the Nominal Account category of the Golden rules of accounting. When the salaries are paid on 4 January, the cash account is credited for the full week’s salaries. Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period’s salaries. Salaries expenses are another example of accrued expenses for which adjusting entries are normally made. An adjustment is necessary because the date that the salaries are paid does not necessarily correspond to the last date of the accounting period.

But what happens for expenses that you’re incurring but don’t know how much the cost will be? For example, for electricity, you’re billed after the fact based on the amount you use. You’ll create another entry on Feb. 10 when you pay the invoice. Let’s say that you bought $1,000 worth of office supplies and you pay the vendor the same day.